FAQ

Frequently Asked Questions

General Questions

How does Checkflo work?

Checkflo handles check printing and mailing for businesses. Simply submit your payment data (via CSV file or integration), and your checks will be printed using the matching check template for that bank account. We securely process and deliver them to your payees—typically on the same day. You also receive delivery updates, reports, and a Positive Pay report to submit to your bank.

What security measures are in place to protect my payments?

Checkflo ensures bank-grade security for your data and payments. We are SOC 2 Type II certified, HIPAA certified, and committed to GDPR standards, ensuring the highest level of data protection and regulatory compliance. We use advanced fraud prevention tools, TLS 1.3 & AES-256 encryption, and strict access controls. Checks are printed in secure, monitored facilities with automated handling to eliminate risk.

How does Checkflo integrate with existing accounting systems?

Checkflo offers flexible integration options, including CSV upload, API integration, and a direct QuickBooks Online (QBO) sync. For high-volume businesses, we also support custom payment solutions like SFTP. Contact us for tailored integration options.

Where are all the checks mailed from?

All US-mailed checks are processed, printed, and mailed from our secure U.S. fulfillment facility in Champlain, NY, ensuring reliable and timely delivery within the United States. Canadian checks are printed and mailed from our secure fulfillment center in Montreal, QC, ensuring efficient delivery within Canada.

How long do checks take to be delivered?

Checks submitted before 1 PM EST (Monday to Friday) are mailed the same day.

- USPS First-Class Mail: Typically 5-10 business days.

- Expedited Shipping: FedEx Overnight with guaranteed next day delivery.

- Other USPS Options: Additional mailing choices with tracking are available.

Can multiple users or teams use Checkflo?

Yes, Checkflo is designed for multiple teams or departments to manage check payments securely. It supports unlimited bank accounts and custom check templates. Each user can be assigned specific access controls based on their role, ensuring separation of duties if needed. Check issuance accounts can be structured per bank, company, or department, allowing different teams to collaborate while maintaining clear boundaries and workflows.

Can I customize my checks and attach documents?

Yes, Checkflo allows you to customize both the check and check stub. You can add static data (such as company logos or fixed messages) and dynamic data (such as payment details, invoice numbers, or recipient-specific information). You can also attach supporting documents to be mailed with your checks.

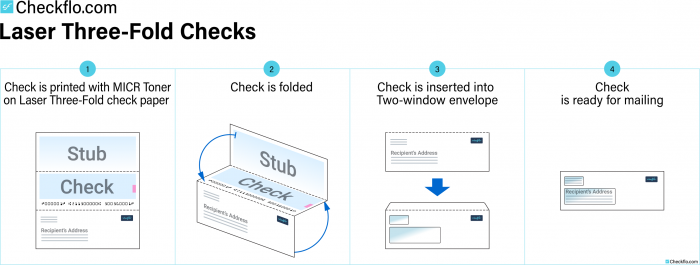

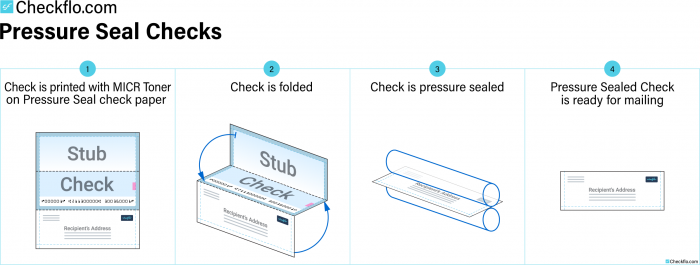

What types of business checks does Checkflo offer?

Checkflo uses proprietary high-security check stock with tamper-proof technology and bank-compliant MICR printing. We offer two types of check paper: Laser Three-Fold Checks and Pressure Seal Checks, both designed for secure and efficient payment processing.

What kind of reporting and tracking does Checkflo offer?

Checkflo provides delivery tracking with expected and actual delivery dates, real-time return mail alerts, and detailed payment reports. You also receive a Positive Pay report to submit to your bank for fraud prevention.

How long does it take to get started?

Getting started with Checkflo is quick and easy. Our cloud-based platform requires no downloads, and we aim to validate and activate accounts the same day. If you use CSV upload, you can start mailing checks immediately after activation.

About Our Services

Check Printing & Mailing

Business Owners

If you’re honest with yourself, you’ll likely admit that your current check writing process is incredibly time-consuming each week. Writing those payroll checks, customer refunds, vendor checks and tax payments by hand is time spent inefficiently.

Accountants

Your bookkeeping customers are as unique as their fingerprints. Each one comes with a different set of policies and requirements for issuing payments, and this is where you shine! Your accounting software is able to keep up with the numerous transactions and bank accounts, but, when it comes to printing checks, it’s falling short — or worse, it’s not even a viable option for your firm.

Check Pricing

The best way to find out whether Checkflo is right for you is to use it! Our starter plan has all of the basic features needed to get started.

App User Guide

Read our App User Guide if you have questions about importing checks, recipient address, bank account setup, etc…

APIs and Webhooks

Checkflo APIs and webhooks provide an easy, cost-effective way to manage check and document uploads, automate mailing, and track shipments—keeping your operations smooth and efficient from start to finish.

Learn more

Ready to get started?

No monthly fee; no credit card required.