About Checkflo

Check printing & disbursement solution for Businesses and Accounting FirmsModernizing Check Printing

At Checkflo, we specialize in secure, automated check fulfillment—printing and mailing checks for businesses across industries. We work with accounting firms, financial institutions, property management companies, healthcare providers, legal services, and payment platforms that need a reliable, high-volume check processing solution.

We are a trusted provider in the check fulfillment space, handling millions of dollars in check payments each month for businesses across the U.S. and Canada.

Who Uses Checkflo?

✔ Accounting Firms & Payroll Providers – Automate payroll and vendor check payments.

✔ Property Management Companies – Send HOA, COA, and utility payments via check.

✔ Healthcare & Legal Services – Mail checks with attached documents and statements.

✔ Payment Platforms & FinTech Companies – Offer check payments as an option for clients.

✔ Businesses Across All Industries – Process refunds, rebates, settlements, dividends, loan disbursements, and other check-based payments.

What Sets Checkflo Apart?

Trusted by Regulated Industries – Used by businesses in finance, healthcare, and legal sectors that require secure, compliant check payments.

We Own the Entire Process – Cloud-based platform, proprietary check stock, and in-house fulfillment centers—no outsourcing, full control, and direct courier integration for real-time tracking.

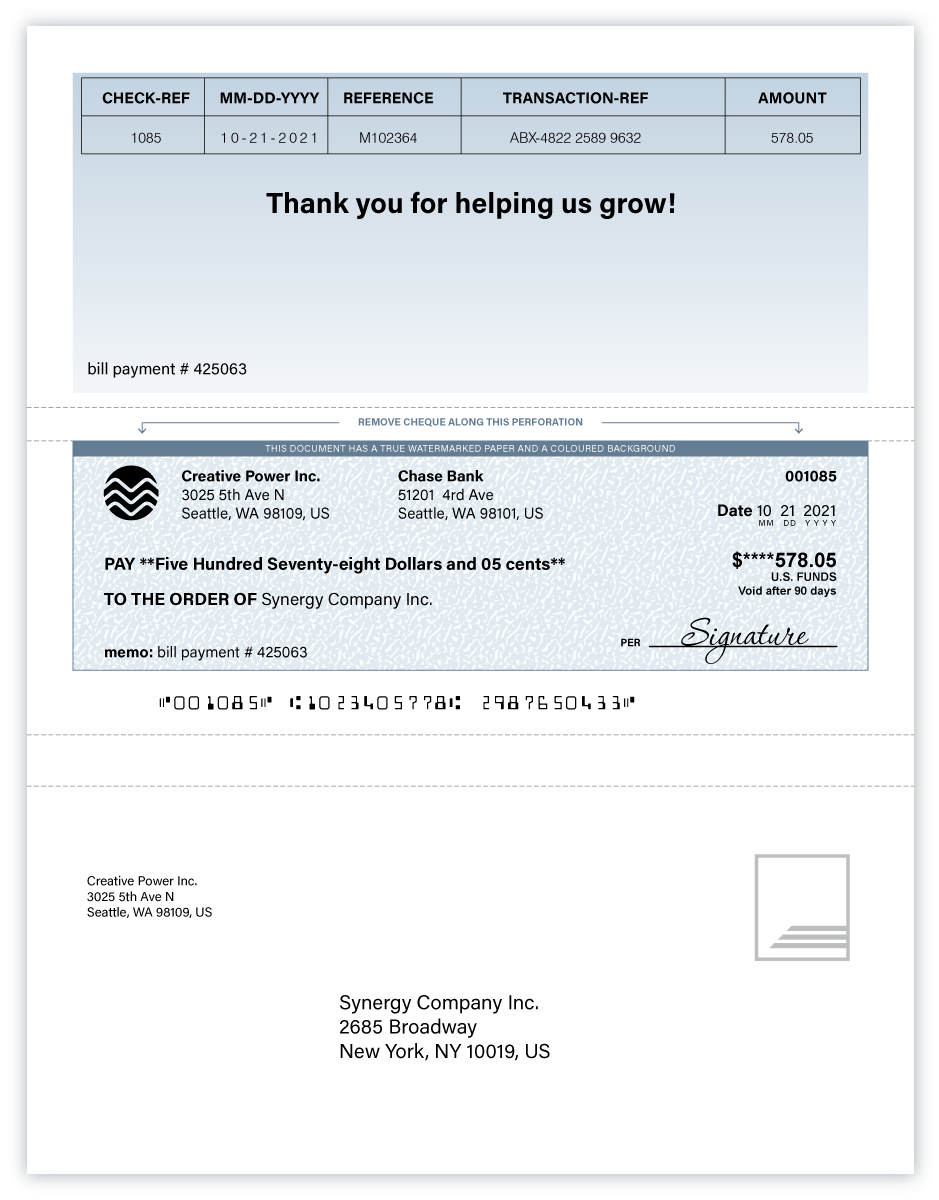

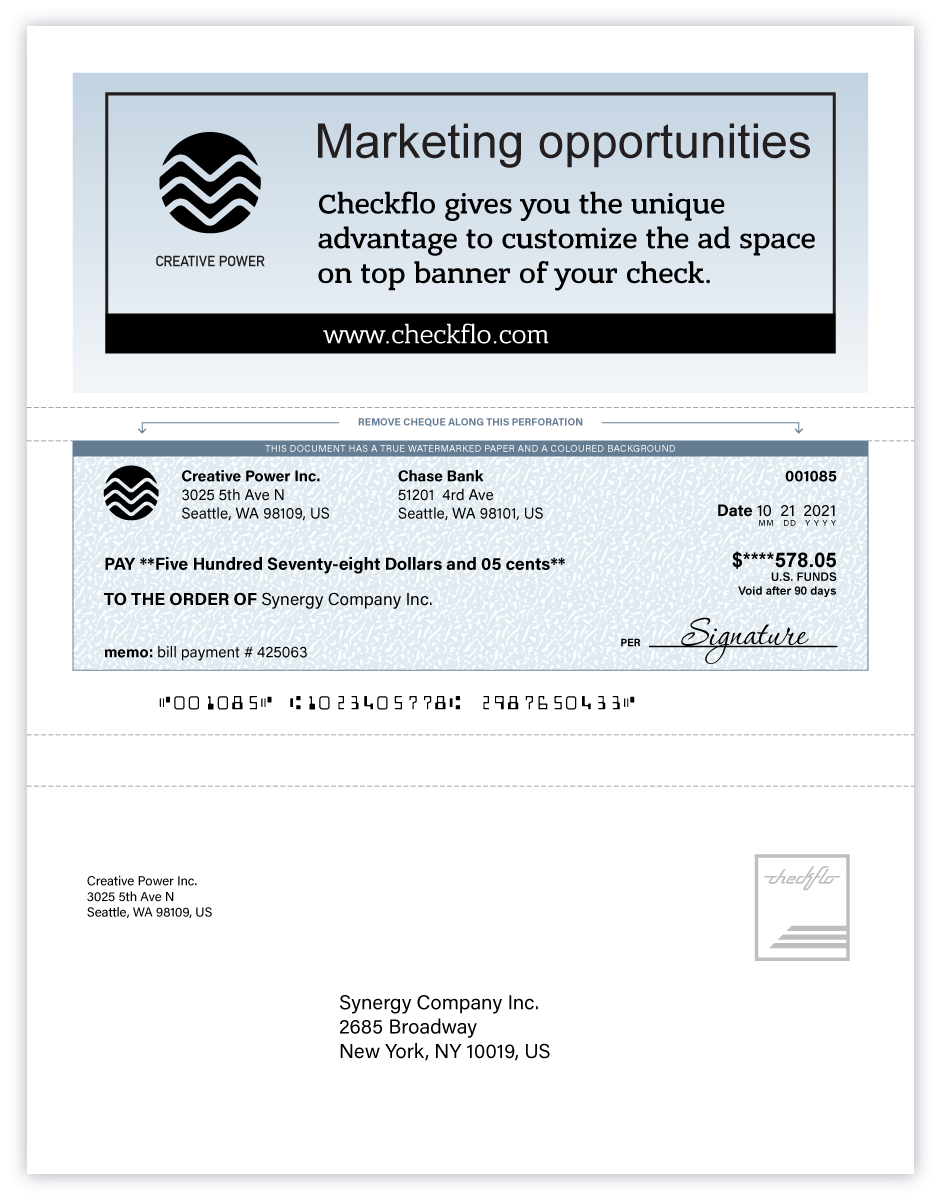

Custom Workflows & Integrations – We tailor check templates, approval rules, payment processes, and system integrations to fit your operations.

Flexible Integration Options – Connect via API, SFTP, bulk CSV uploads, or white-label solutions with ERP and financial system compatibility.

Transparent Pay-As-You-Go Pricing – One flat rate per check—includes printing, postage, tracking, and reproting with no setup fees or monthly costs.

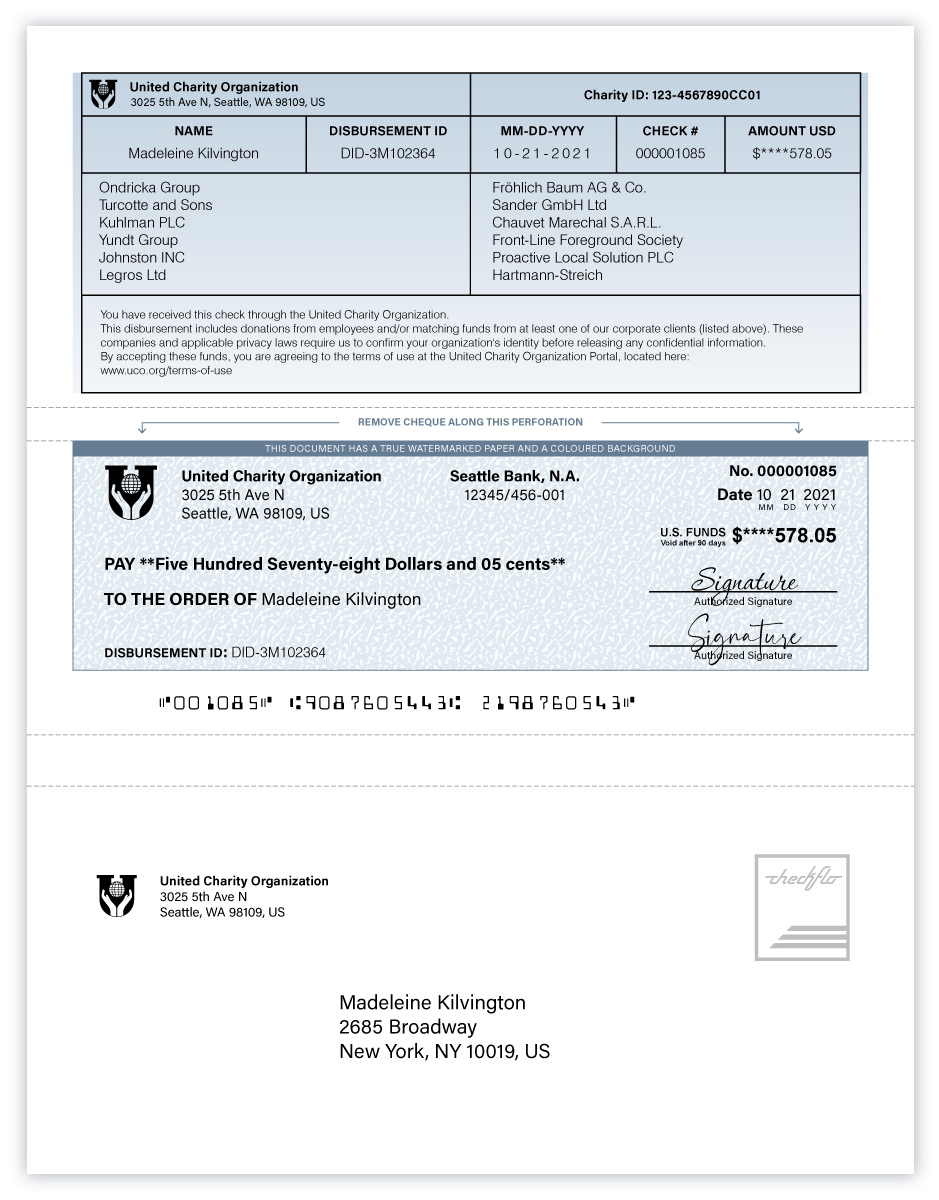

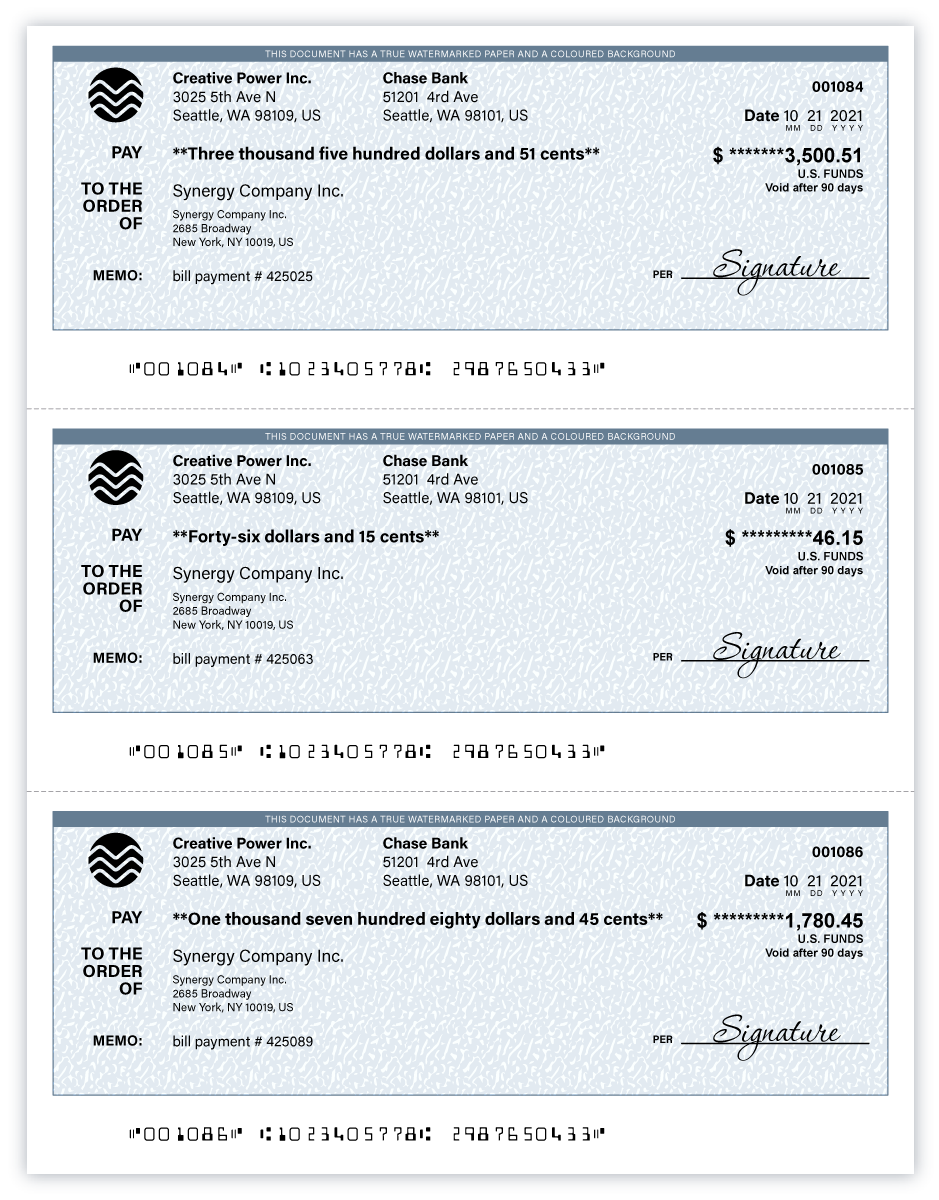

Custom Check Capabilities: Tailored to Your Business Needs

Checkflo gives you the flexibility to choose between standard bank checks and fully customized check templates that cater to your specific needs.

Security and Compliance Across Every Step

Checkflo is committed to providing industry-leading security across all sectors. Our platform ensures secure data handling through encrypted digital systems, strict access controls, and in-house protocols for printing and mailing. From check payments to fulfillment tracking and detailed reporting, we prioritize data protection at every step, giving businesses full transparency and peace of mind.

HIPAA certified: Protecting Healthcare Data

Checkflo is a HIPAA-compliant check printing vendor, meeting strict healthcare privacy and security regulations for protected health information (PHI). Our compliance ensures secure data handling, with robust controls like encryption, secure data storage, and regular audits to safeguard PHI. For healthcare providers, insurers, and third-party administrators, we provide a Business Associate Agreement (BAA), offering reassurance that sensitive patient information remains private and fully compliant.

SOC 2 Type 2: Verified Data Security and Integrity

Our SOC 2 Type 2 certification demonstrates our commitment to the highest standards of data security, availability, processing integrity, confidentiality, and privacy. This attestation is crucial for businesses relying on secure, outsourced check printing and payment services. With SOC 2 Type 2 compliance, our platform is verified to manage sensitive data safely, ensuring accurate, reliable, and secure processing that meets industry standards.

ISO 27001 Certification in Progress

Checkflo is in the process of achieving ISO 27001 certification, the international benchmark for robust information security management. This certification will add to our robust security framework, offering even greater assurance to industries like finance, healthcare, and legal services that prioritize secure and reliable data handling.

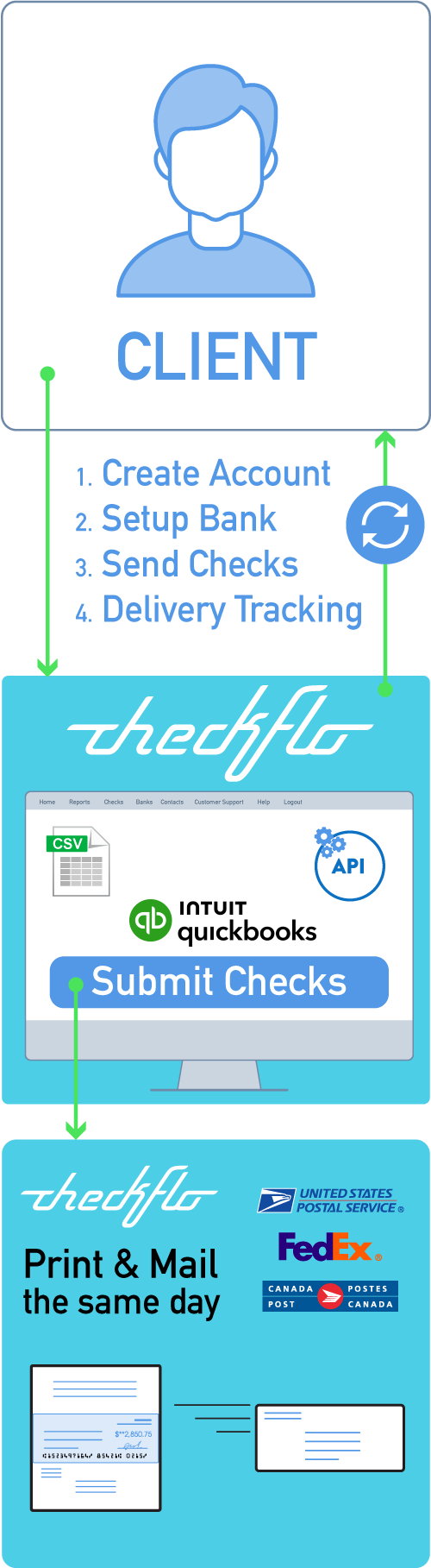

What Do I Need to Get Started?

At CheckFlo, we strive to provide a seamless and secure check issuing experience for businesses of all sizes. To get started with our platform, we’ve outlined a simple registration process that ensures your business and account information is accurate and verified. Here’s what you need to get started:

- Create an Account:

Register for a free account on our website by providing your name, email address, and phone number. After registering, you will receive an access code to explore our platform. - Business Information:

During the registration process, we’ll ask for essential account holder and business details such as your business name, address, registration number or EIN. This information helps us verify your business identity and ensures that you are authorized to issue checks on behalf of your company. - Bank Account Details:

To enable you to accurately create and customize checks using our check writing software, we require your bank name, address, routing number, account number, and a digital or scanned image of the authorized signer’s signature. Providing this information allows us to verify your bank account, maintain the security and integrity of the check-issuing process, and ensure that the checks you create are valid and recognized by financial institutions. - Account Verification and Activation:

Our account creation, verification, and activation process is designed to be quick and efficient, often allowing you to start sending checks on the very same day. By prioritizing the security and integrity of our platform, we ensure a seamless and reliable experience for all of our users.

Rest assured that the security and privacy of your data are our top priorities. We follow strict privacy regulations and industry best practices to ensure your sensitive information is encrypted and stored securely. For more details, please refer to our Privacy Policy.

Ready to get started?

No monthly fee; no credit card required.