How to sync QuickBooks bank account with Checkflo

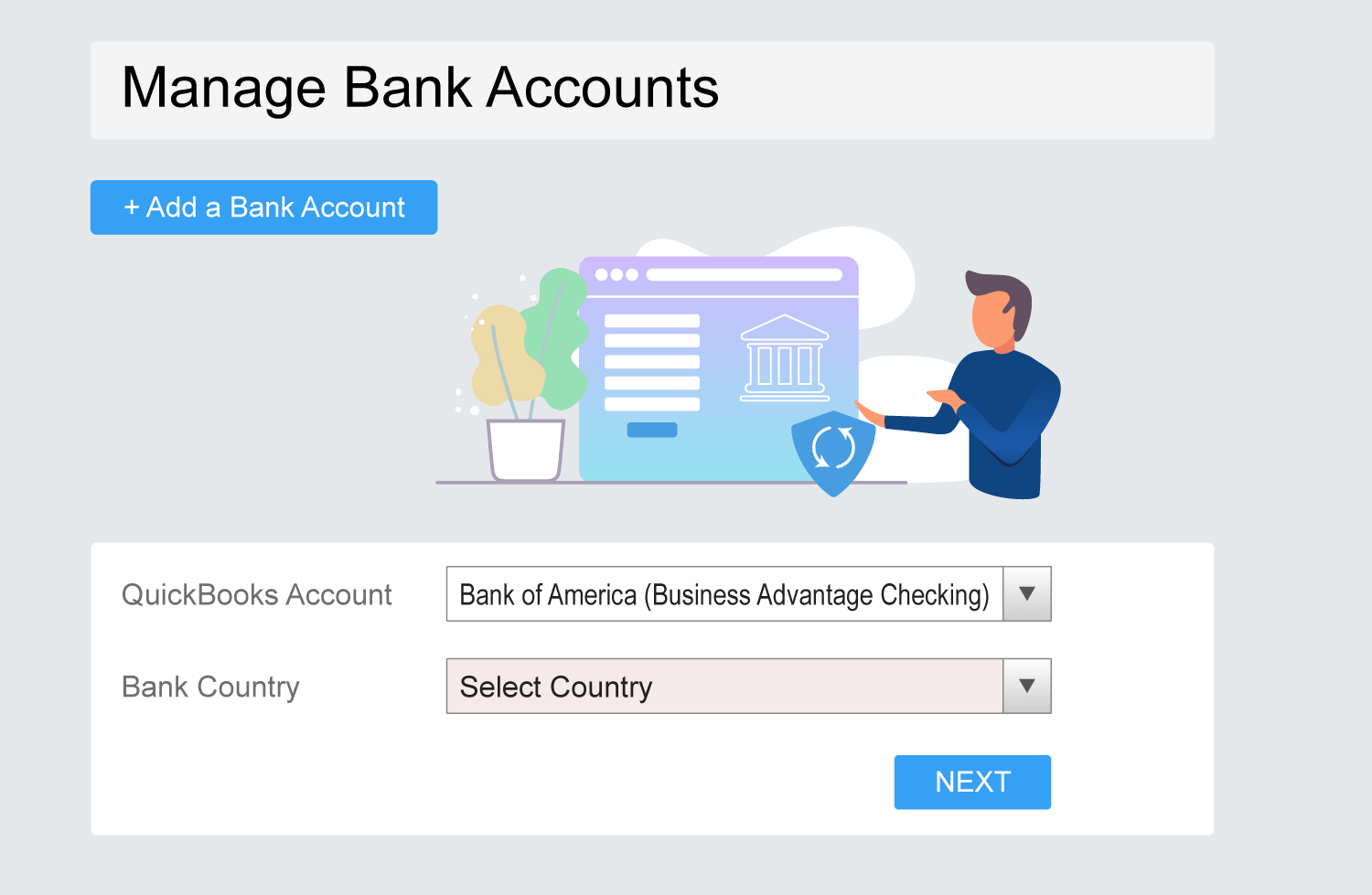

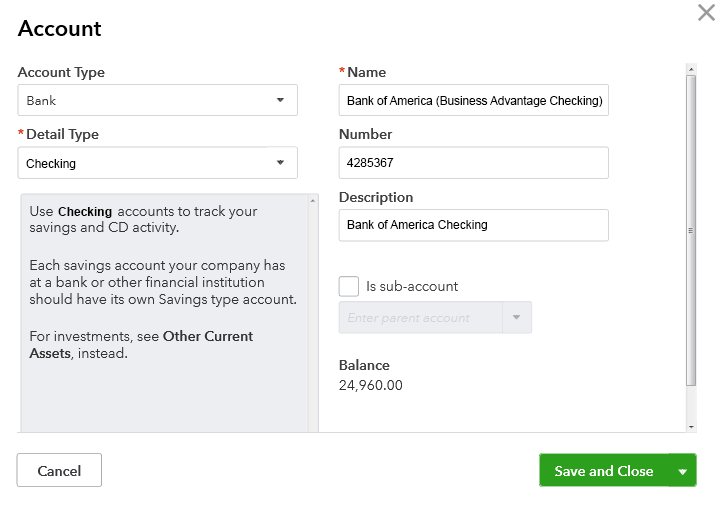

Step 1: Add New Bank Account

Once you fill in the sign up form, please select the Bank account that would like to have your check funds pulled from. This Bank account needs to be associated to your QuickBooks account as well, as seen below.

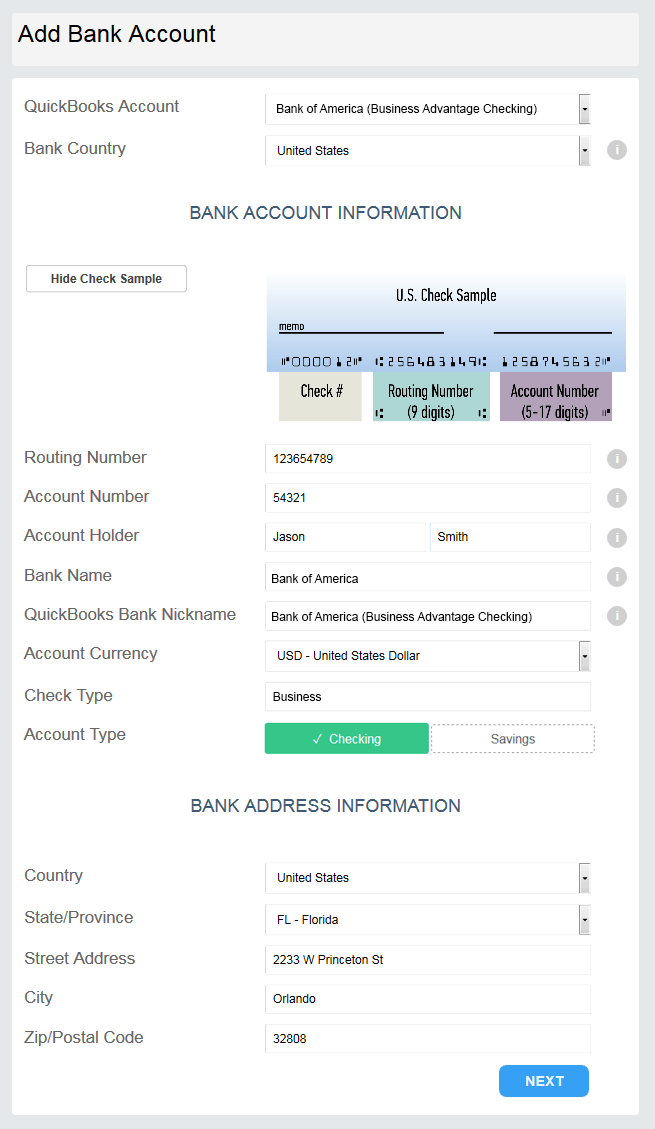

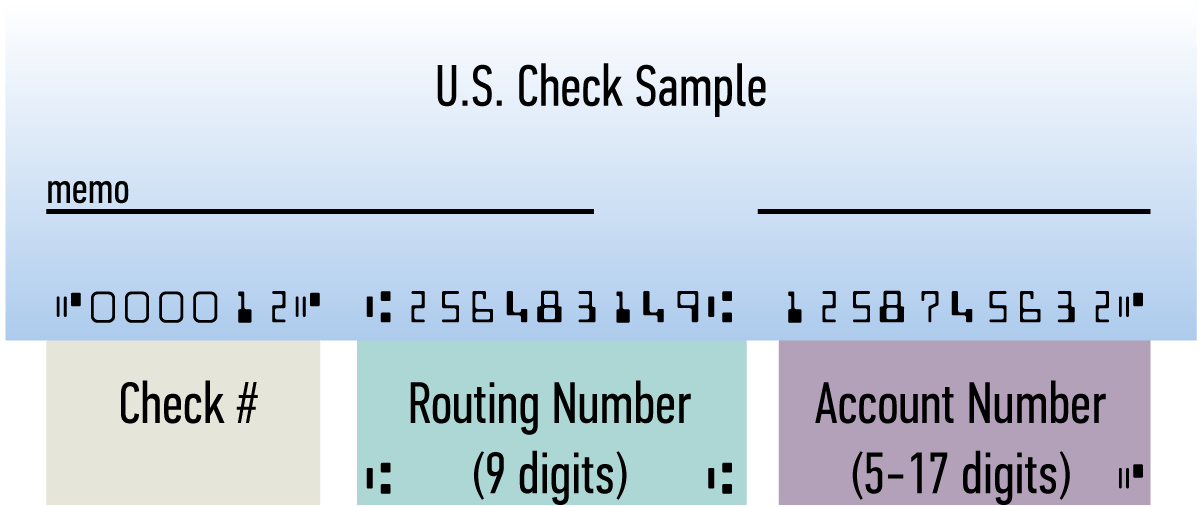

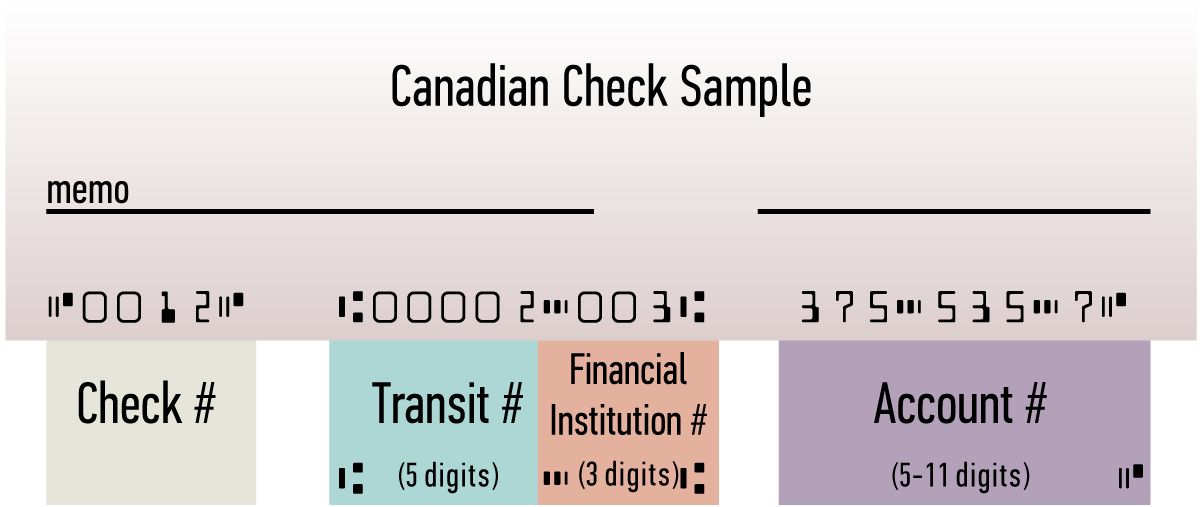

Step 2: Enter Bank Information

Please enter your bank’s account information such as the bank routing number, account number, and the account holder’s name. For the section named “Bank Address Information” please enter your bank’s branch details.

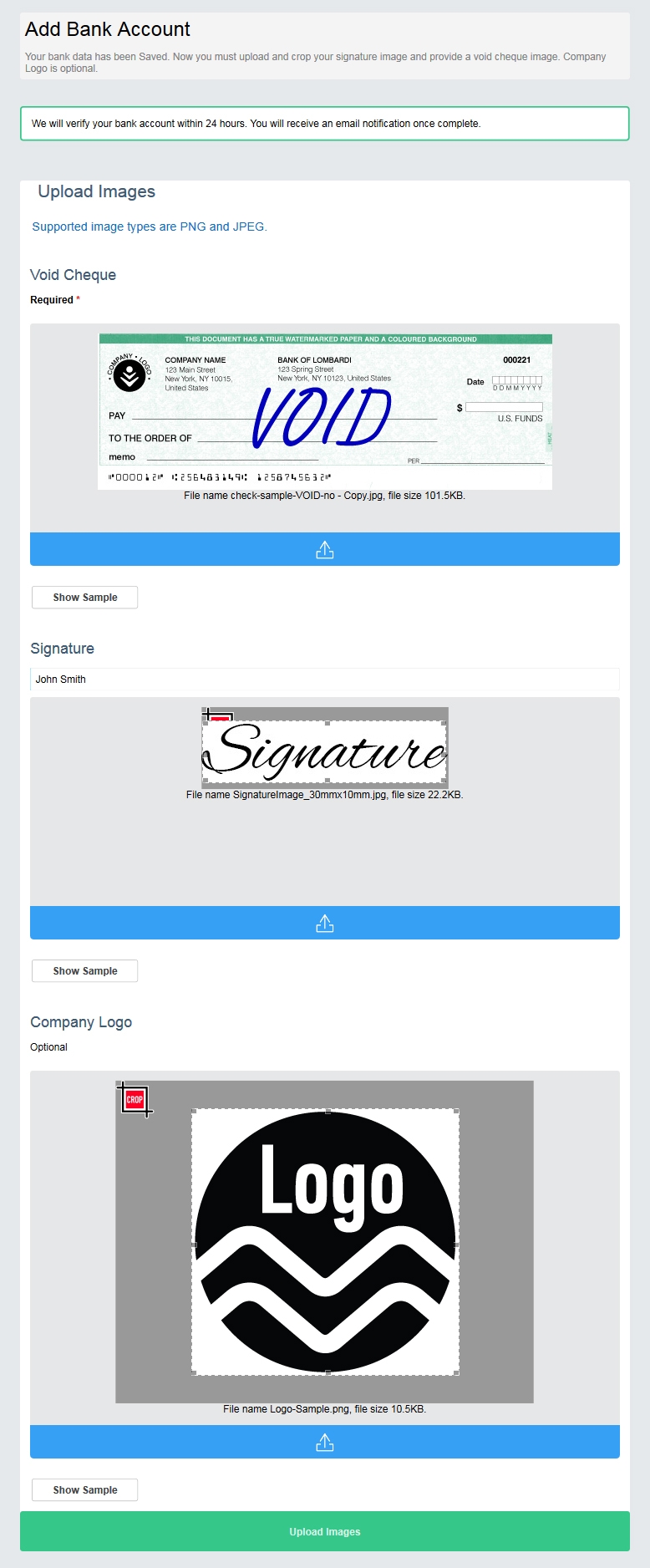

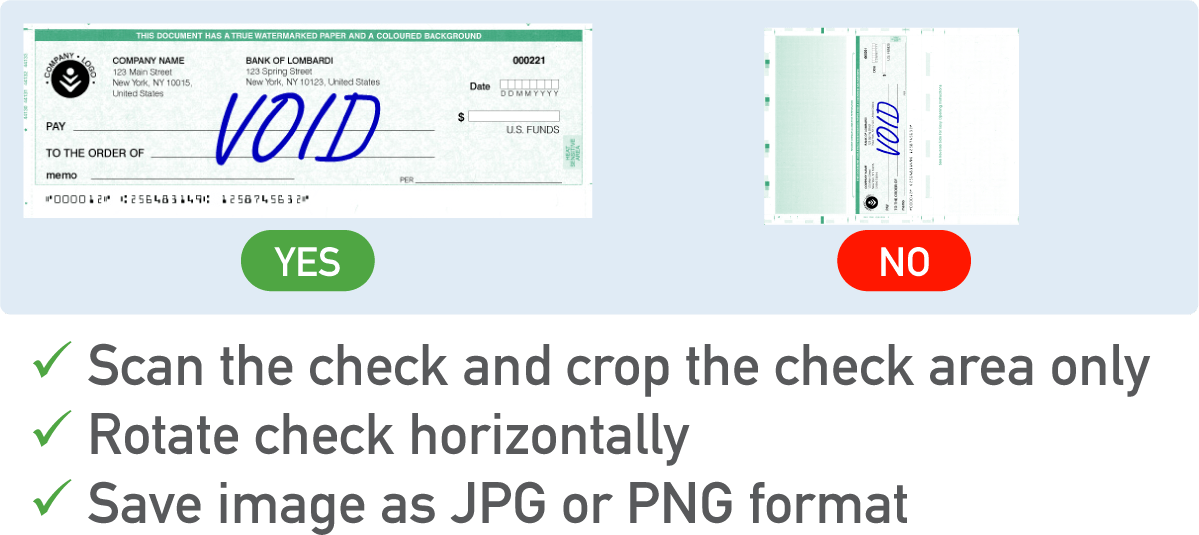

Step 3: Upload Images

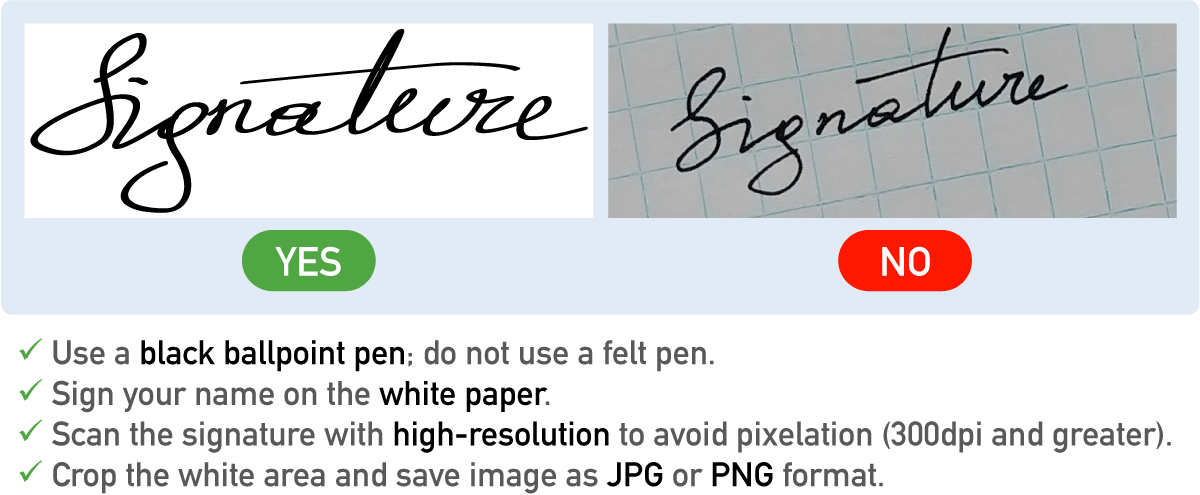

Please upload an image of a void check from the bank account that you selected in step 1. Next you would need to upload an image of your signature, this signature will appear on the checks. Its recommended to use a blank white sheet of paper and a black pen. Next would be to scan the signature in high-resolution to avoid pixelation (300dpi and greater). Once uploaded to the Checkflo platform you need to crop the white area. Additionally, you can upload your company’s logo if you chose too, we would recommend that the logo have a white background and the logo be in black, you would then need to crop the white area as seen in the image.

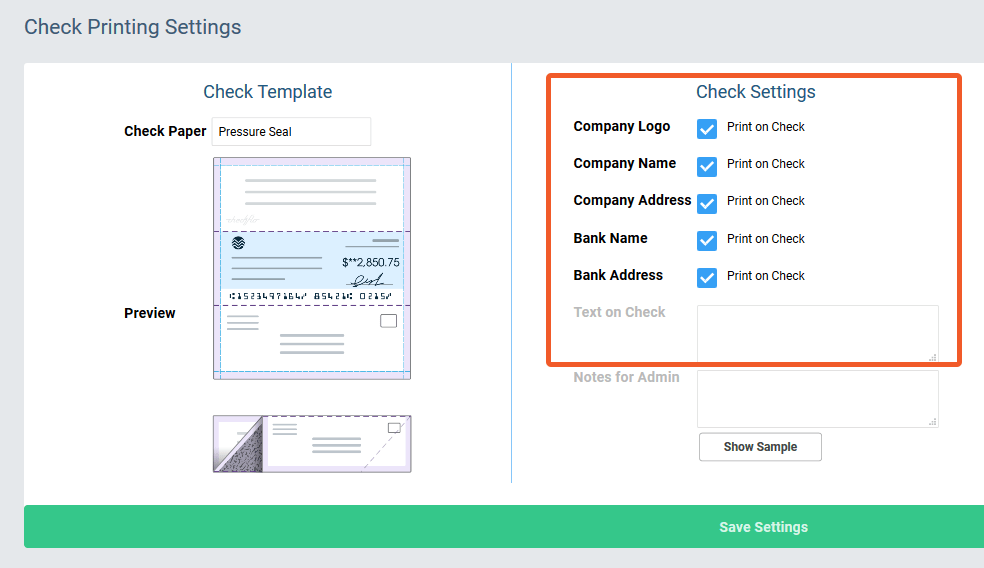

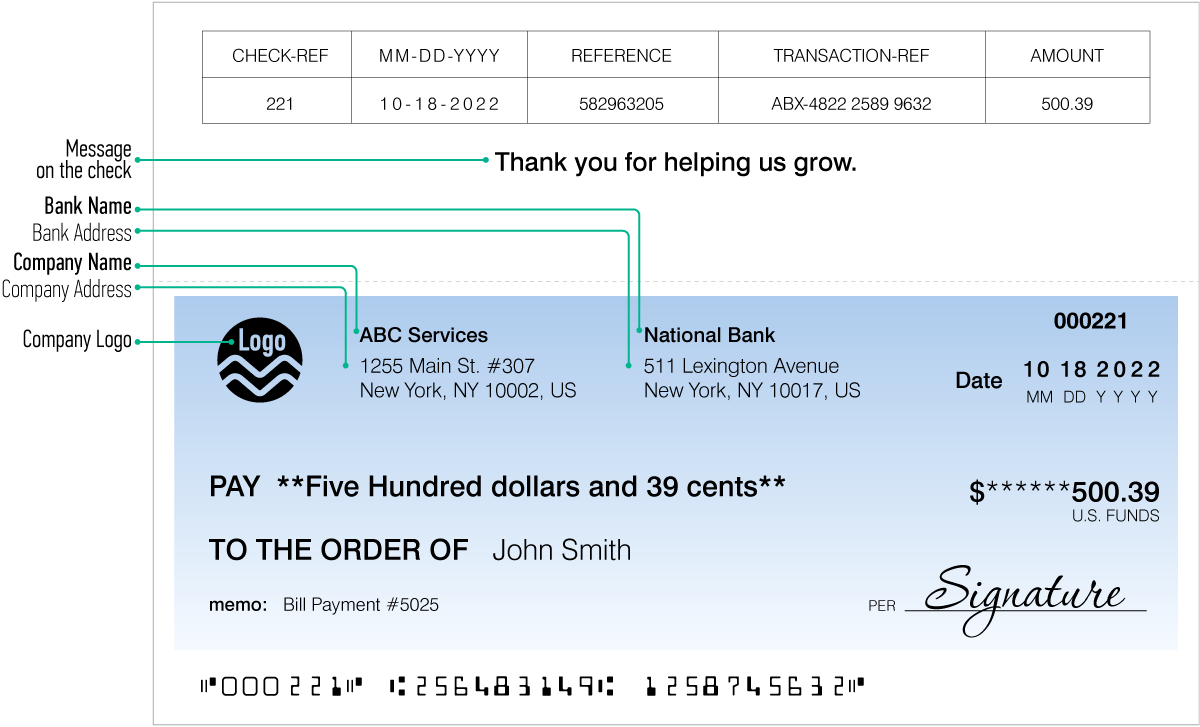

Step 4: Set Check Printing Settings

On this screen you are able to chose the information that can be displayed on the check, such as your bank’s address or your company’s address. Additionally, you have the possibility writing a message that will be displayed on the top flap of the check as seen in the image below.

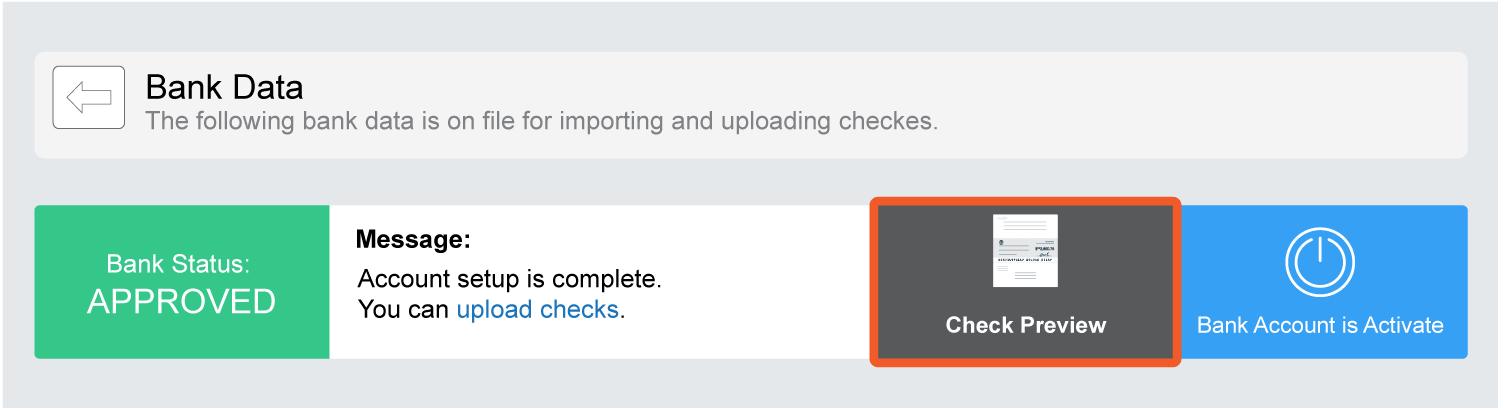

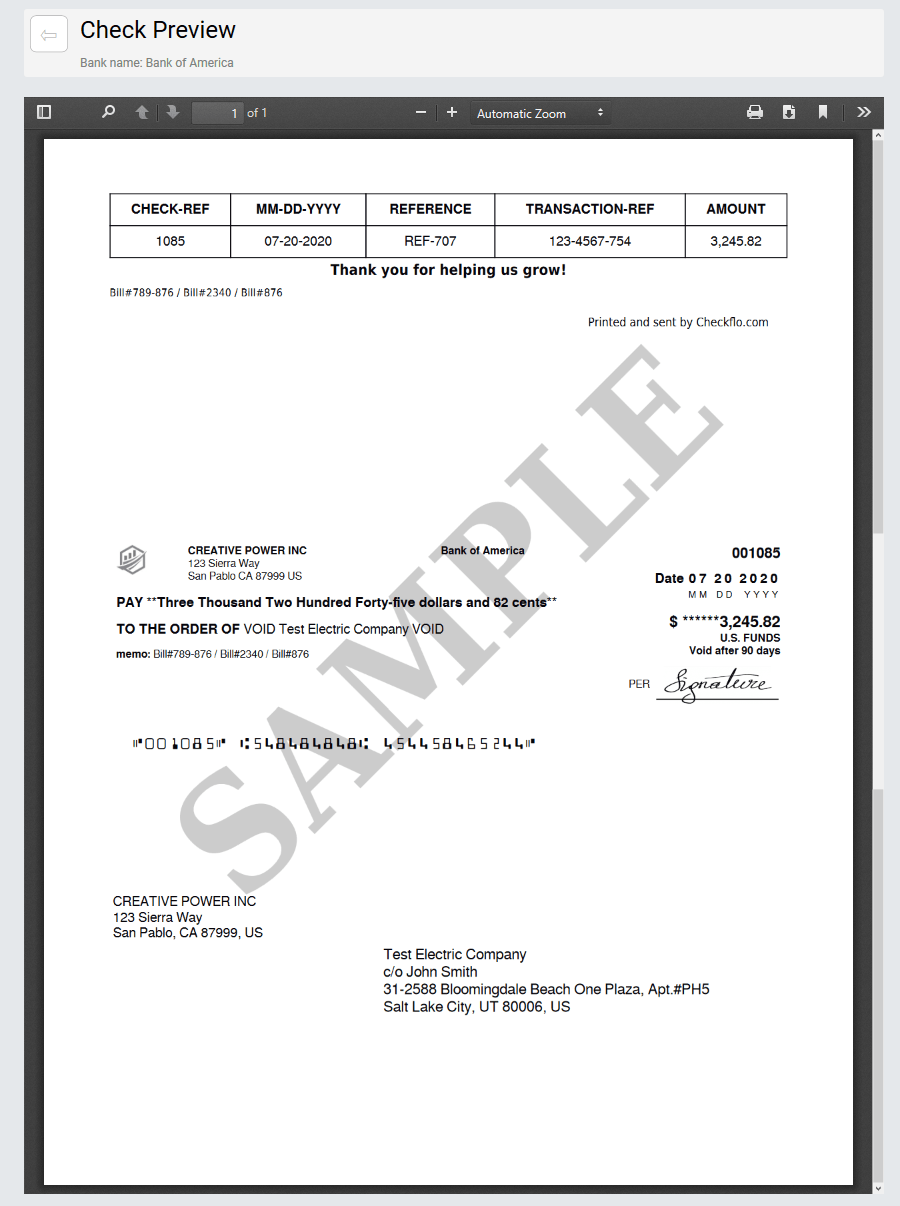

Step 5: Check Preview

Once you click on complete bank registration button on the previous page, you will see this screen below, letting you know that your account status is pending. Our administrator will review all the information you provided in the previous screens, you will be notified once the account has been approved. Additionally, you can see a sample check with your company logo and all the information you chose to display on your check.

You will receive an automatic email notification letting you know the status of your account and that its under review by our administrator.