Automated Business Checks

Outsource check printing and mailing to save hours each week and reduce costs. Checkflo’s secure automation eliminates manual errors, protects against fraud, and ensures every payment is compliant.

Business Check Printing & Mailing Services

Maintain complete operational control through advanced system integrations, batch processing workflows, and real-time tracking.

Integrated Payment Processing

For businesses looking to automate and manage check issuance through secure accounting or ERP integrations.

- Integrate via API, CSV, QuickBooks, or SFTP

- Batch processing, scheduling, and approval workflows

- Full visibility into user actions and payment history

Custom Checks with Documents

When your business needs to send more than just a check—like legal notices, payroll statements, or insurance letters.

- Attach letters, forms, or supporting documents

- Custom check stub with dynamic financial data

- 100% match accuracy between checks and documents

High-Volume, Fast Turnaround

When speed and scale are essential—whether you're sending bulk check payments or working on tight deadlines.

- Same-day dispatch for orders submitted before cutoff time

- FedEx overnight delivery available for urgent payments

- Supports bundling and large batch processing

Multi-Bank, Multi-Team Setup

Ideal for managing check payments across multiple teams, entities, or clients. Simplifies complex payment operations.

- Set up multiple bank accounts with dedicated check templates

- Create primary accounts and subaccounts for different teams or companies

- Add multiple users, assign permission levels, and set approval rules

Choose Your Check Processing Model:

Option 1: Standard Check Processing

Use Your Existing Bank Accounts

Print and mail checks using your current banking relationships. You provide bank account details for check design – we handle printing and mailing without accessing your accounts.

Best for: Regular vendor payments, payroll, refunds, and standard business disbursements

Option 2: Prefunded Check Processing

Bank-Managed Custody Accounts

Streamline operations with FBO (For Benefit Of) accounts managed by our banking partners. Choose self-service or full-service management (you send funds, we handle all issuance, printing, mailing, and reconciliation).

Best for: High-volume operations, trust payments, multi-entity structures, regulated industries requiring enhanced compliance

Plug-and-Play Workflow Integrations

Plug Checkflo into your existing workflow without code rewrites or mapping headaches – always at $0 setup cost.

Upload & Go: Drag and drop CSV export files or PDF bundles for same-day onboarding.

Batch at Scale: Secure SFTP hot folders accept high-volume data files (EDI included) plus matching PDFs in one sweep.

Real-Time API: Stream payment data and PDF documents or EDI payloads through REST endpoints with instant webhook status updates.

CSV Data File Upload REST API Integration QuickBooks Online Integration

The Checkflo Advantage

Security first, flexibility everywhere.

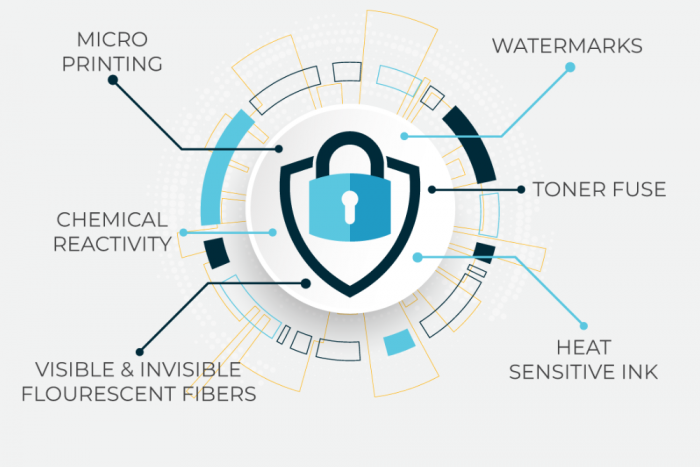

Bank-Grade Security

SOC 2 Type 2, HIPAA, and ISO 27001 certified. Payment and bank data stay AES-encrypted; every check prints on high-security MICR stock with optional holograms. IP-restricted access and immutable audit logs protect your payments from submission through deposit.

Custom Payment Solutions

Choose self-serve templates for fast edits, drop in your logo, tweak business details, and go. Need more? Our enterprise team builds fully custom HTML layouts, multi-page stubs, and automated document-matching rules for complex requirements. Perfect for payroll, refunds, or any business payment that needs its own look.

Granular Approvals and Controls

Role-based permissions, dual-signature rules, and dollar thresholds keep every check under tight oversight. Positive Pay exports and real-time exception alerts stop fraud before it starts. Approvers get instant email alerts; rejected items flow back so nothing stalls your pay run.

Live Tracking & Reporting

Each check and document ships with USPS or FedEx tracking that feeds straight into your dashboard. Web-hooks and downloadable reports surface print, mail, and delivery milestones in real time. Ready for auditors, ERP feeds, or just peace of mind.

Cut Your Check Processing Costs by Over 50%

Compare the Savings: In-House Check Printing VS Checkflo

In-House

Check Printing & Mailing

- Monthly Materials: $500

- Monthly Postage: $335

- Monthly Labour: $1,280

Checkflo

Check Printing & Mailing

* NO MONTHLY FEE

* $1.49 per check printed & mailed:

-

- High-security check stock

- Original MICR toner

- Fast 1-day dispatch

- Positive Pay report

- Reporting & tracking

Customer Reviews & Testimonials

Discover how Checkflo has helped businesses of all sizes streamline their payment processes and enhance their financial management.

Checkflo - Web Application

Check Payment Software

Reviews

Overall

(39 reviews)

Stay Informed

Explore the latest news, tips, and best practices in check payment management and financial insights through our blog.

Payflo Partners with MoneyGram to Deliver Innovative Cash Payment Solutions for U.S. Gaming and Lottery

Payflo Inc. has partnered with MoneyGram to launch groundbreaking cash-in and cash-out payment solutions tailored for the U.S. gaming and lottery industry. With seamless integration, same-day access to funds, and nationwide reach, this partnership is set to transform payment experiences for both players and operators.

Blog

Leverage USPS Informed Delivery for Better Business Mail Visibility

Unlock better mail visibility and security with USPS Informed Delivery and Intelligent Mail Barcode. See how Checkflo simplifies tracking checks and financial documents for your business.

Reverse Positive Pay: Adequate Security for Your Business?

Discover the pros and cons of Reverse Positive Pay for check fraud prevention. Understand how it differs from Positive and Payee Positive Pay, and see how Checkflo’s solutions enhance business security and streamline payment processes.

Take the next step

Get your first five checks for free!

No monthly fee or no credit card required.

Contact us

Contact representative

See all services